And the revolution is just beginning.

Nothing in the energy business can compete with oil for volatility, geopolitical drama, or sheer utility. Its low price per barrel, currently under $50, won't last forever. But it may last through the year ahead.

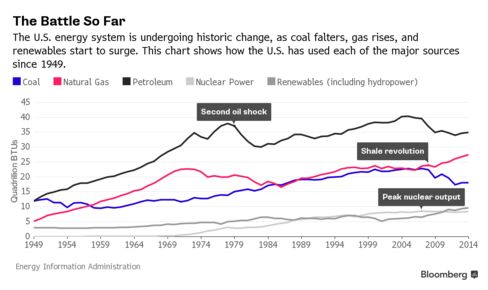

What will be changing at a historic pace in 2016? Everything else. Gas. Coal. Solar. Wind. Batteries. Cars.

This is every energy source for itself, one clawing its way over another for markets, financing, subsidies, and friendly policies.

Coal is the biggest loser, broken and bleeding, as banks—Citigroup being only the latest—decline to lay out funds for new plants. New laws, such as President Obama's Clean Power Plan, are locking in less polluting fuels, and the international climate movement is trying to zero out carbon emissions in the decades ahead. This year, the coal industry is expected to see its biggest drop in consumption ever.

Beyond coal's pain, change is so monumental that it's difficult to say who the winner will be. It's easier to say what won't be. Nuclear won't. It's kind of running in place, benefiting from its status as a low-carbon power source but suffering from its expense and most everyone's reluctance to welcome new reactors in their backyards.

Natural gas is the coal killer, undercutting coal's price as a power generation fuel. The abundance of American gas will keep the world market for liquefied natural gas supplied well through 2020. Low prices are great for destroying competitors, but they can leave investors hurting.

Renewables are no longer "alternative energy." Solar power is competitive with fossil electricity in more and more places every year—watch China, India, and Chile in 2016. Global demand for the sun reached a new high this year, and solar is that rare thing that liberals and many free-market conservatives in the U.S. can agree to love. Wind power is cheaper than coal in Germany and the U.K., which may close all its coal plants by 2023.

Which brings us back to oil. Prices may stay low thanks to resilient U.S. output, renewed Iranian exports, and Saudi Arabia's strategy to sell at whatever price it needs to maintain market share. And there's a funny thing about oil that you might not have noticed. It doesn't really compete with the other energy sources. It powers cars, ships, and planes. The others generate electricity.

So the true wild card for oil, beyond any 2016 price whips, is how fast cars start to run on electricity instead of gasoline. If electric vehicles unify transportation and generation, that would draw the lifeblood of civilization into the no-holds-barred energy slugfest.

No comments:

Post a Comment