Ruth Porat brings Wall Street discipline to the freewheeling search giant

Google is known for multicolored bicycles, nap pods, and complimentary meals—and the free-spending ways that come with those perks. Now it wants to be known for something else: financial discipline. To whip the numbers into shape, it’s brought in Ruth Porat, an almost 30-year veteran of Wall Street.

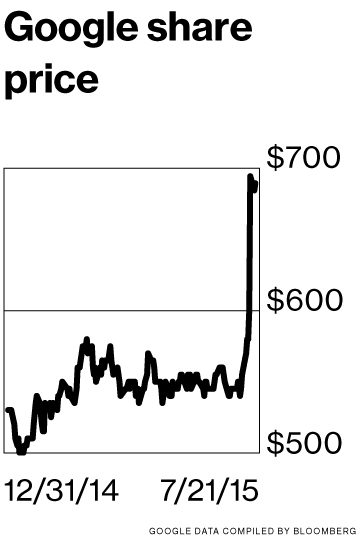

She’s off to a good start. Porat, who joined Google as chief financial officer in May after five years as Morgan Stanley’s CFO, on July 16 unveiled second-quarter earnings and sales that topped analysts’ estimates. Impressed investors sent the shares to a record the next day, adding $65 billion to the company’s market value and more than $4 billion each to the fortunes of co-founders Larry Page and Sergey Brin.

Shareholders cheered Porat, 57, with her strong finance background, as the right person to help instill more discipline at a company that’s invested in everything from driverless cars to giant barges. Now she must prove she can create efficiency without crimping the creative culture that’s helped Google dominate the online advertising market. “No one really knew her before, because there’s no reason a tech investor would really know her,” says Gene Munster, an analyst with Piper Jaffray. When she announced the second-quarter results, the idea that a Wall Street hand was whipping Google into shape “kind of went viral,” he says.

“This perception of a real, hard-nosed woman who has something to prove—I think that inspires confidence.”

During the second quarter, Google’s operating expenses grew 13 percent from the same period a year ago, the slowest rate since 2013, and declined from the previous quarter. “A key focus is on the levers within our control to manage the pace of expenses while still ensuring and supporting our growth,” Porat said on a call with analysts. Her remarks also left open the possibility of Google returning cash to investors in the form of buybacks or dividends, something Wall Street has been asking about for years. At a companywide meeting following the earnings report, she talked about the importance of disciplined execution at Google even as she thanked employees for their work, according to a person familiar with the remarks. A Google spokeswoman declined to comment.

Porat benefited from the efforts of her predecessor, Patrick Pichette. Google’s increase in expenses started slowing during the first quarter. “Everything was probably already in motion by the time she came along,” says Sameet Sinha, an analyst with B. Riley & Co. Even so, the quarterly numbers seemed to resonate with investors, as did Porat’s résumé. “She comes with a pedigree from Morgan Stanley of doing a good job of enhancing shareholder value over her tenure there,” says Walter Price, co-manager of the AllianzGI Technology Fund, which owns shares of Google.

At Morgan Stanley, Porat helped the bank recover from its near-death experience during the financial crisis and developed a reputation as a cost-cutter who focused on boosting shareholder returns. In 2013 she laid out expense-reduction targets of $1.6 billion and last year gained approval for the bank’s biggest share buyback in four years. This year, the company more than doubled the share repurchase plan. Since the end of 2012, Morgan Stanley stock has climbed from $19 to more than $40.

Porat, a physicist’s daughter who was born in Silicon Valley, is no stranger to technology. As Morgan Stanley’s top Internet banker during the dot-com bubble, she advised clients such as EBay and Amazon.com and made pitches to tech startups considering going public, accompanied by her close friend Mary Meeker, the research analyst who was called “Queen of the Net.” Porat showed a passion for work, quickly diving back in after having each of her three sons and after a battle with breast cancer.

Connecting with Google shareholders will be a priority. After the earnings call, Porat, who traded pantsuits for jeans at Google, planned to begin meetings with investors in cities such as New York and Boston, making the case for Google’s prospects.

Announcing Porat’s hiring in March, Page said she would “invest in a thoughtful, disciplined way in our next generation of big bets.” She received a pay package worth more than $70 million that will vest from this year through 2019, according to a company filing. In her first months on the job, she’s been reviewing programs throughout the company. They include driverless cars, which seek to use technology to take humans out of the process; Project Loon, an effort to deliver Internet connectivity to rural and remote areas via high-altitude balloons; and Google Fiber, its broadband and TV service in select cities, according to a person familiar with the matter.

Some of those initiatives may have to be abandoned. “She might have to go and tell Larry and Sergey, ‘Here are 10 projects, pick five—let’s go with those,’ ” Sinha says. The Google Fiber project could get a hard look, according to Munster, because it competes with established companies such as Verizon Communications and AT&T that are focused on building and delivering broadband and TV services.

Lifting the share price is crucial for Google, where many employees get much of their compensation in stock and can easily jump to a rival such as Apple. In the year before Porat was named to the job, the shares had fallen 4.5 percent while the Nasdaq Composite Index had climbed 17 percent. “Retention is the biggest challenge,” Munster says.

Google’s issues go beyond cost control. They include a threat to its core business of selling ads next to search results. As consumers access the Web via smartphones instead of desktop PCs, they’re increasingly likely to tap on an app rather than open a browser.

At the same time, Google faces stronger competition in online commerce from Amazon, which is grabbing more users who skip comparison shopping on Google and buy from the retailer. Also, Facebook, growing more quickly than Google, is competing for advertising and is a threat to Google’s YouTube business as it pushes video options to its users. “It was a good quarter, but it doesn’t mean there aren’t a lot of the same structural and competitive concerns,” says Ben Schachter, an analyst at Macquarie Securities.

The bottom line: Investors welcomed Porat by adding $65 billion to Google’s market value after she presented second-quarter earnings.

No comments:

Post a Comment